By Joe Firmin 1-minute or 10-minute read… your choice.

If you Google the title to this post, you’ll come up with many “top 5-10 reasons to invest…” type of posts or articles on the topic. They are great posts so definitely check them out as a quick introduction (ahem, after you read this…).

I want to make sure you are introduced to the topic but also are educated enough to understand the investment. So, if you just want a high level, I’ll give you that and let you know when to stop reading. If you want more detail, I’ll give you that... and then just keep reading!

High Level:

Here are the key reasons to invest in multifamily assets: Cash flow. Tax advantages. Forced Appreciation. Scale. Market trends. Multiple streams of income. Hold value. Improving people’s lives. Bettering communities. Cheap financing. Leverage. Usage of property management. Lower inherent risk. Hedge against inflation.

OK, that’s it. Stop reading if you just wanted high level. If you’d like more in-depth explanation of each of those reasons, then here we go…

Wait! What’s “Multifamily”?

Yeah, let me back up. “Multifamily” is the term for the investment class of real estate assets that is considered residential multifamily housing. Meaning, any residential housing that is 2+ housing units under one roof. Multifamily refers to many building types, from duplexes, triplexes, apartment communities, mobile home parks, or even townhome communities. The range of multifamily assets go from luxury (Class A) to low income or Section 8 (Class D) to very distressed (Class F).

A key differentiator in the real estate industry is whether the asset is greater or less than four units. If it is four units or less, it is considered “residential” by lending institutions. Five or more – it is known as “commercial.” This is mainly for two purposes: 1) Valuation – residential loans are valued based on comparison sales to similar type homes in the immediate surrounding area. This is why the value of your personal residence is dependent on the values that other like homes in your area have sold at over the past 6-12 months. For commercial loans, the value is determined by the income the asset (property) generates. If you can increase the income or decrease the expenses, the value will increase, and the property appreciates. More on this in a bit…

OK – now on to the reasons to L.O.V.E. Multifamily. (Hey! That rhymes!)

Cash Flow!

Multifamily assets provide steady monthly income over the course of ownership when managed properly. The cash flow is secured by the lease. The lease that the paying residents sign prior to moving in. The lease is key. It has the rules and regulations, within the proper federal and state legal limits, to ensure the resident upholds their parts of the agreement and the owner of the property upholds theirs as well. This lease provides the security an owner needs to invest while limiting risk. A benefit is cash flow! When the property is purchased and then managed well, it will be profitable and provide monthly cash flow to the investor/owner.

Tax Advantages

Multifamily properties benefit from many government tax incentives because you are providing a great benefit to a community – a clean and respectful place to live. Housing has always been treated well by government bodies because they recognize the need and its inherent contribution to a functioning society. There are many tax advantages, but I’ll only list a few here. I’ll have to write another post about tax advantages specifically…

Depreciation: Because a multifamily building is considered a residential commercial asset, it can be depreciated over time, 27.5 years to be exact (for other types commercial buildings it is 39 years). Just the building and not the land – God only made so much land. That means, each year, you can take a portion of the value you paid for the building and deduct it against the income of the property. That’s huge. Say you bought a multifamily residential property for $300,000 and the building was valued at $275,000 (and the land $25,000). That same property created $10,000 in income that year. You can deduct $10,000 ($275,000 ÷ 27.5 years) from that income, leaving you with ZERO taxable income. Boom… how do you like them apples!

Other deductions: Just like your personal residence, you can deduct mortgage interest. In Addition, because this is an asset and a business, any necessary business expenses you have can be deducted: closing costs, property management fees, property taxes, travel costs, etc. That taxable income is looking pretty low now.

Cost segregation: In tax law, you can segregate the costs/value of the different parts of a commercial real estate property to be depreciated separately. This means that different parts of the property are not all equal in how they should be depreciated. In my simple example above, I depreciated the building on a 27.5-year timeline. The building itself should be, but not everything in it. Personal property such as furniture and appliances, carpeting, and window treatments is depreciated over a 5- or 7-year depreciable life. Land improvements such as sidewalks, parking lot repaving, or landscaping, are subject to a 15-year depreciable life. The actual building or structure is depreciated over 27.5 years. This is powerful as it only further can decrease the taxable income in a given year.

1031 Exchange: This tax strategy allows an investor to “defer” paying capital gains taxes on an investment property when it is sold, as long as another “like-kind property” is purchased with the profit (capital gains) from the sale of the first property. So, if you sold a property and you received a profit of $100,000 from the sale, you would have to pay ZERO in taxes on it if you used that $100,000 to purchase another similar property. You’ve essentially “deferred” your tax payment… and yes, this can go on forever if you teach your kids…

Who would’ve thought taxes would be so fun! OK, I’ll cool my jets. Let’s move on…

Forced Appreciation

Forced is a strong word… but it’s true. Like I mentioned above with the key differences in valuation, you can cause the appreciation through your own efforts. If you increase the rent by $50/month, it can have a big impact with multifamily. As an example, let’s keep this super simple. Say you have a 10-unit building, let's call it The Spot. Rent is $1,000/month per unit. So, 10 X $1,000 X 12 months = $120,000 in gross income via rents per year. For this example, let’s say that expenses are $20,000. So, your net income (profit) on the property is $100,000. Still with me… OK. Now, let’s increase the rent by $50/month/unit. It is now 10 X $1,050 X 12 months = $126,000 per year. In one year, just by increasing the rents and nothing else, you got another $6,000 in income. All else being equal, your new net income is $106,000.

I’m going to introduce a new topic… the ‘capitalization rate’ or ‘cap rate.’ In commercial real estate, the cap rate is the rate of return you would get if you paid cold hard cash for the property. If someone says, “The property costs $1,000,000 at a 5% cap rate.” That means… You can expect to receive a return of $50,000 as an annual return on that investment of $1M cash.

If you don’t get the cap rate thing, go back and read that again. It can be a little difficult at first, but also… here’s another example for you right here…

Continuing our forced appreciation example from above, let’s use a 5% cap rate for it. You previously had a net income of $100,000 before the rent increase, right? Take the $100,000 ÷ 5% cap rate = $2,000,000. This is the value of your property in the market. Since you have increased the income of The Spot by $6,000, at a 5% cap rate, you increased the value of the property by $6,000 ÷ 5% = $120,000!! Wow!! Now The Spot is worth $2,120,000! Good work!

That’s the power of forced appreciation. Now, imagine the appreciation you could get if you not only increased rents, but also decreased expenses and lowered vacancy, you can really see the value you can create!

Scale

For starters, think about construction costs. Apartments use common roofs, walls, foundations, etc. The investor starts off with more square footage to rent at a lower cost per unit.

Next, the management of many single-family homes requires more travel, more roofs, more plumbing, more individual systems, but with multifamily, the units are in one place, fewer roofs and systems. Easier to manage = lower cost of management. Property management for multifamily costs much less to the investor than a single-family home.

Because there are more units in one place, the costs are lower per unit. Take landscaping for example. You may pay $120/mo. for a single-family home, but for a duplex, all the sudden, that cost per unit was just cut in half! Now expand that to a larger apartment complex – your economies of scale are much better, and that is only one cost example…

Costs for fixtures, appliances, and materials are also cheaper per unit, easier to manage and install. With uniformity comes scale and cost reduction. This same logic on fixtures and landscaping goes for financing and taxes as well – cheaper per unit cost.

Just like a 12-pack of beer – they’re cheaper the more you buy.

Ability to have onsite property management (for large apartment complexes)

We talked about management being easier, more efficient and less costly with multifamily. Property management can also be controlled, and a culture created when you have onsite property management. Typically, the finances of a smaller apartment community cannot carry the burden of full-time property management and maintenance onsite, but over 80+ units, you can swing it depending on the asset class. This is helpful to truly understand and curate a culture within the complex and provide a specific experience for the resident.

Market trends

Here are some bullets:

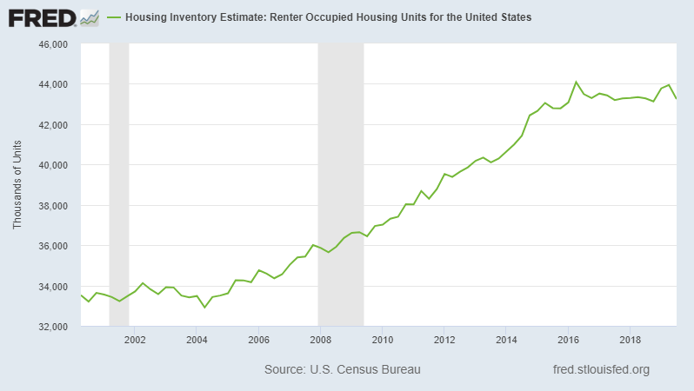

- The U.S. Census Survey discovered that home ownership has dropped significantly over the past 10 years, from almost 70% of the population to about 65% in 2020. That’s a lot of people moving to apartments from homes.

- Many want the freedom to move, live in more urban environments and enjoy the amenities of apartments that come without the headaches of maintenance with home ownership.

- There are 75 million baby boomers retiring over the next 10 years, they’ll want new digs with an empty nest. 10K people are turning 65 years old every day in the U.S.

- Younger generations are spending more time in the renter pool, putting off having kids until later.

- Pew Research found that 88% of the population growth in the U.S. will be due to immigrants and they are 40% more likely to rent than native-born residents.

Multiple streams of income

This one’s simple… more units, more streams of income. If you have a single-family home, you’re dependent on that one unit for income. With multifamily, you can make 1 purchase and have multiple streams. This plays into the next one…

Lower inherent risk

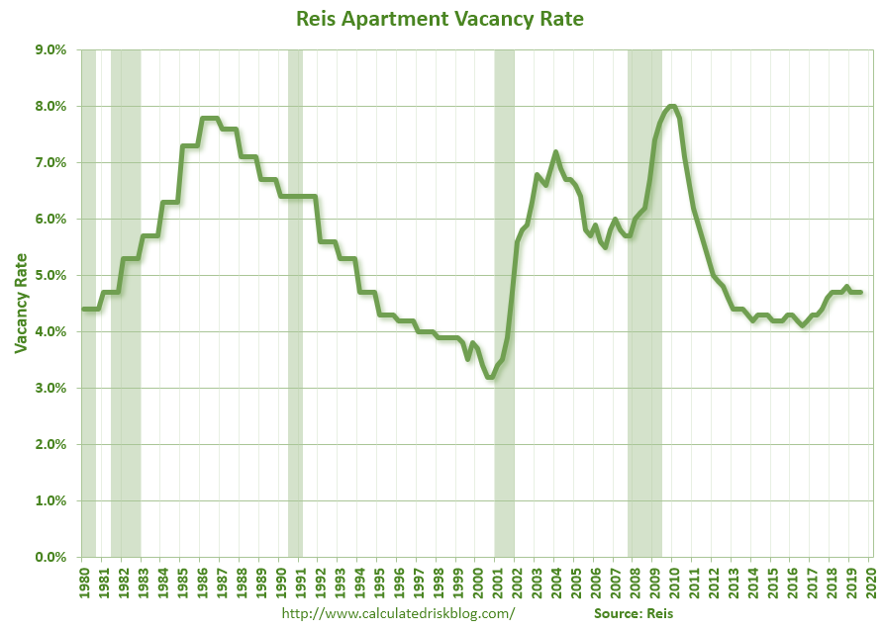

With more units, there is less risk due to vacancy. If you own a single-family home and it goes vacant, you have 100% vacancy. If you own a 20-unit apartment complex and 1 unit goes vacant, you have 5% vacancy. Big difference. You can absorb more risk and spread it out with more units.

Shaded areas = Recessions Source: REIS: https://www.calculatedriskblog.com/2019/09/reis-apartment-vacancy-rate-unchanged.html

Hedge Against Inflation & Hold Value

The Federal Reserve aims to hit an annual inflation rate of 2%. Don’t believe me? See here. That’s 2% less your savings and purchasing power is worth in 1 year. Your stocks, bonds, etc. returns are 2% less than you think. An investment in multifamily real estate is a hedge against inflation because if it’s going up – then rents are going up, increasing the net income and hold value of the property. You’ll get your return and the Fed isn’t stealing 2% of it. What’s more – the mortgage is fixed so that’s nice. So, along with inflation, your property value goes up and the revenues with it, making your return and appreciation more stable in the long run.

Improving people’s lives. Bettering communities

Investing in real assets like multifamily, allow you to not just improve the look and feel of a property, but truly improve a community, its surroundings, the crime rate, quality of life in the area, and ultimately the lives of the residents in the apartments. If you invest with someone that values its residents and wants to ensure their experience of the property is a positive one, you are directly impacting those residents’ lives. Few investments can give you this sense of accomplishment, fulfillment and goodwill. So cool.

Leverage

Ah the power of leverage… Tell me where you can use someone else’s money and it increases your rate of return. Would the bank loan you money to go invest in stocks? Nope. Why not? Risk. Plain and simple. Banks like collateral.

You can control a $500,000 asset with $100,000 (or less). You put up the $100,000, the bank lends you the rest, you keep all the cash flow less the mortgage payment and expenses. This is huge. Let’s go back to The Spot example...

Remember that if a property is marketed as “$1,000,000 at a 5% cap rate” that means that you can expect $50,000 in cash flow per year on an investment of cash of $1,000,000.

Let’s say you used leverage instead of cash to purchase The Spot. Keeping simple math, you invest $200,000 and get a loan from the bank to purchase the property for the balance ($800,000). Assuming the same $50,000 in income, you are now receiving that same income not on $1 million, but on $200K. So, your new rate of return is $50,000 / $200,000 = 25%. Much better than 5% right? That’s pretty sweet, that’s the power of leverage. It’s even better when you can secure that financing on great terms.

Cheap financing

With leverage being a fantastic way to increase your return on investment, we want to get it. Banks like multifamily, they know it is a good investment and historically less volatile than most asset classes. Therefore, they’re willing to offer great financing terms. At the moment of this writing, we’ve heard from multifamily lenders that they are offering 10-yr loans, 30-yr amortization at a 4% interest rate. That’s amazing. With financing like this and leverage providing greater returns. Multifamily investors can take advantage of both to improve their investments.

Conclusion

Whew, if you stuck with me, you just learned a lot about multifamily and the benefits of investing in it. High level again: the key reasons to invest in multifamily assets: Cash flow. Tax advantages. Forced Appreciation. Scale. Usage of property management. Market trends. Multiple streams of income. Lower inherent risk. Hedge against inflation. Hold value. Improving people’s lives. Bettering communities. Leverage. Cheap financing.

Lots of good stuff. If you’d like to invest in multifamily assets, please sign up for our True Freedom Investor Network. It’s free to join with no commitment. It’s also the only way we can send you investment opportunities. Join now!