By Joe Firmin 3 ½ Minute Read

Most of us have a 401k, money in company stock or old Individual Retirement Accounts (IRA) that we rolled over from past jobs. We’ve ridden the wild stock roller coaster of emotions year after year – hoping it will just continue to go up. As Vince Lombardi famously said:

Hope is not a strategy.

You don’t have to have all your nest eggs in one basket, especially one that can be historically volatile. You can diversify and reduce your risk, using your IRA to invest in real estate, without being penalized.

In this article, you’ll learn how to do just that – use a self-directed IRA to invest in real estate, if it’s right for you, pros and cons, etc. If you’re like me, using an IRA to invest in anything other than the stock market was hugely eye-opening. I hope this can really serve you. Let’s jump in.

What is a Self-Directed IRA (SDIRA)?

A SDIRA is an individual retirement account that lets the owner direct the custodian of the account to invest in many different investment vehicles such as real estate, franchises, businesses, precious metals, etc. The IRS regulations require a SDIRA to be held by a qualified trustee or custodian on behalf of the account owner. Taxes are deferred similarly to a regular IRA and there are IRS rules to follow to ensure it is done correctly. Custodians do a very nice job of helping you through this to make it painless.

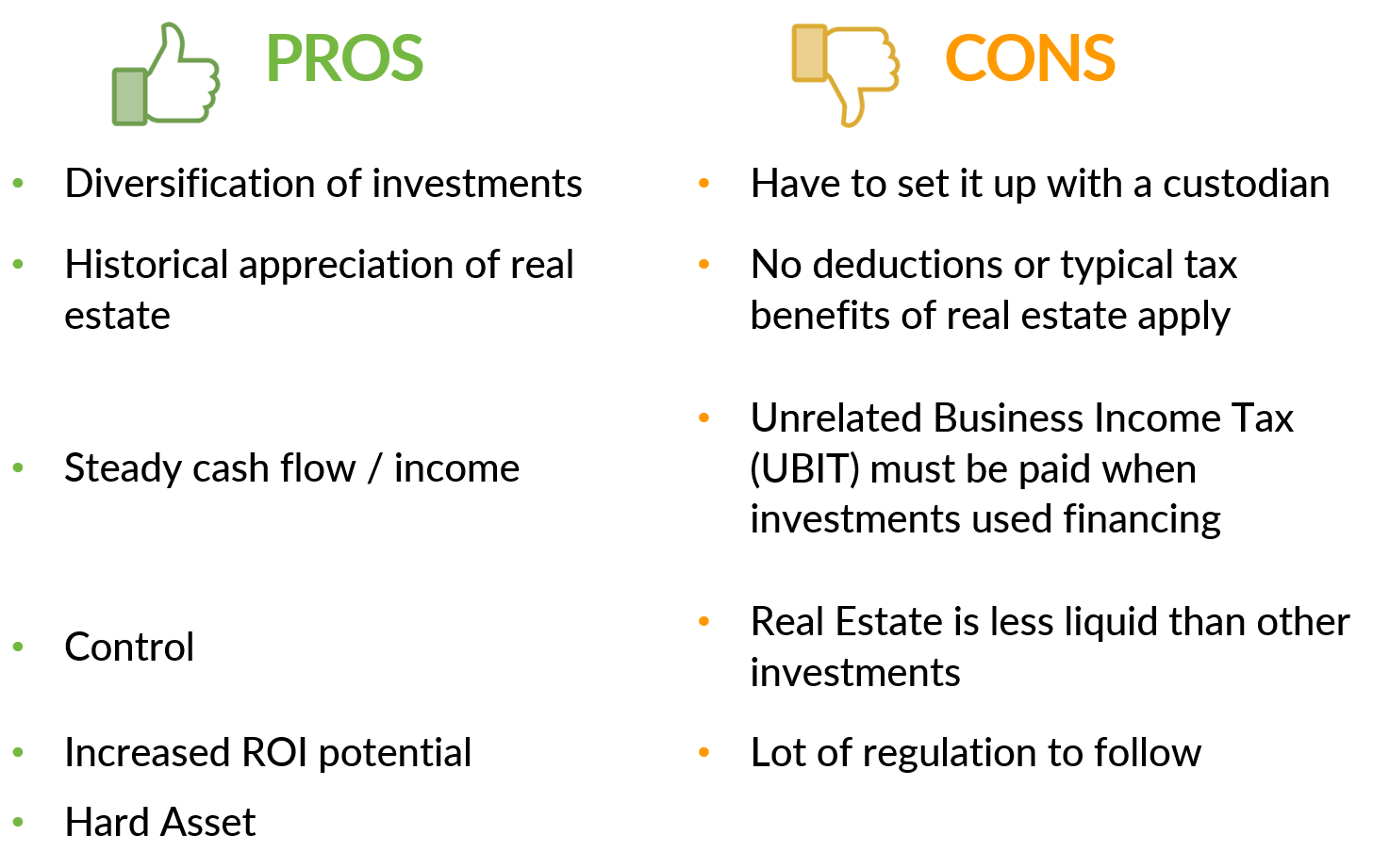

PROS and CONS of Using an SDIRA to Invest in Real Estate

How Does it Work?

Step 1: Get set up.

You’ll want to ensure you’re ready to take advantage of an opportunity before it presents itself. Your SDIRA will be a legal entity, not you personally. You’re the account owner and you must sign up with a respected and reputable IRA custodian. At True Freedom Capital, to make this easier for our investors, we’ve partnered with Advanta IRA after vetting many potential IRA services companies. We don’t receive any commission for this, just want to help you choose a reputable company that will steer you in the right direction.

Step 2: Opportunity.

Know what you want to invest in, identify an opportunity and do your homework. Your money is important, so make sure you protect it by doing your due diligence on an investment.

Step 3: Request the funds.

You’ll need to complete a Direction of Investment (DOI) form via the custodian. Remember – you direct the custodian to make the investments, this form accomplishes that legally.

Step 4: Disburse the funds.

The custodian will process the investment request and disburse the funds where requested.

Step 5: Manage the investment.

If it is an active investment in real estate, you must ensure that all income and expenses come ONLY out of the SDIRA or there will be rule violations. If this is a passive investment in real estate via a syndication, then there will be no expenses to track, only the income via the distributions from the investment. Because the IRA is a retirement account, these funds are held to similar laws and tax structures.

BIG FAT DISCLAIMER

So you're aware, I am not a tax professional, nor do I want to become one, ever, those folks are sharper than me. That being the case, all thoughts and insights (hopefully) in this article are from either my experience, research or discussions with qualified professionals only and in no way represent expertise or legal advice.

For your situation, please speak with your CPA for more details. They'll be impressed.

If you’d like to discuss with me, I’d be happy to jump on a call with you. Schedule a call HERE.

If you’re ready to start exploring passive real estate investing, please sign up for our True Freedom Investor Network. It’s free to join with no commitment. It’s also the only way we can send you investment opportunities. Join now!