By Joe Firmin 5-Minute Read

So, you’re thinking about making an investment. Index funds are all the rage. But you’ve also heard of the long-term track record of real estate and the wealth-building power… what to do? What is the best strategy?

Googling this topic, will yield some great articles. I read many (lots, “muchos”) before sitting to write my take and I have linked some of them below in the sources. I wanted to make sure I presented a balanced view despite my leanings towards real estate.

The Best? (no, not the Ricky Bobby kind)

First, what do I mean by “BEST?” It’s a strong word. In my mind, when making an investment, it comes down to risk-adjusted return. The most bang for your buck when you take risk into account. Risk is part of every investment, so you want to minimize it as much as possible to  maximize the rewards. Thankfully, there’s an app for that, well… kind of. It’s more of a ratio. Created by William Sharpe, it’s called the Sharpe ratio.

maximize the rewards. Thankfully, there’s an app for that, well… kind of. It’s more of a ratio. Created by William Sharpe, it’s called the Sharpe ratio.

Take the investment’s return and subtract the return of a short-term, risk-free alternative investment like a U.S. Treasury bond. Now you have the incremental return, above and beyond “risk-free” investments. It’s then just taking that incremental return and dividing it by the investment’s volatility, measured by its annual standard deviation in value. The higher the ratio value, the better the investment.

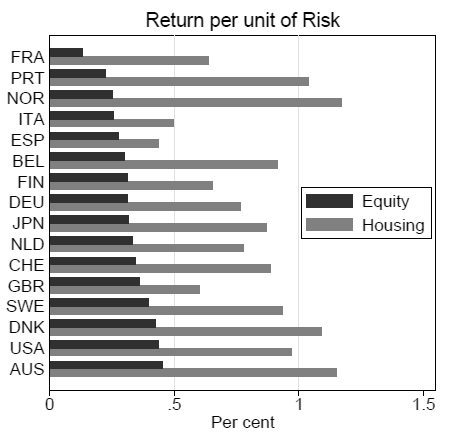

There was a groundbreaking study performed by economists at University of California-Davis, University of Bonn, and the Deutsche Bundesbank (the central bank of Germany) concluded in 2015. They analyzed the annual returns of treasury bills, treasury bonds, equities, and housing from 1870 to 2015 across 16 countries. What does the Sharpe Ratio look like over the last 150 years?

- Treasury bond – 0.2 (lousy)

- Stocks – 0.27 (this is what volatility will do)

- Housing – 0.7

Here’s a slightly different look, but same results...

OK, so you get the point. Pretty neat.

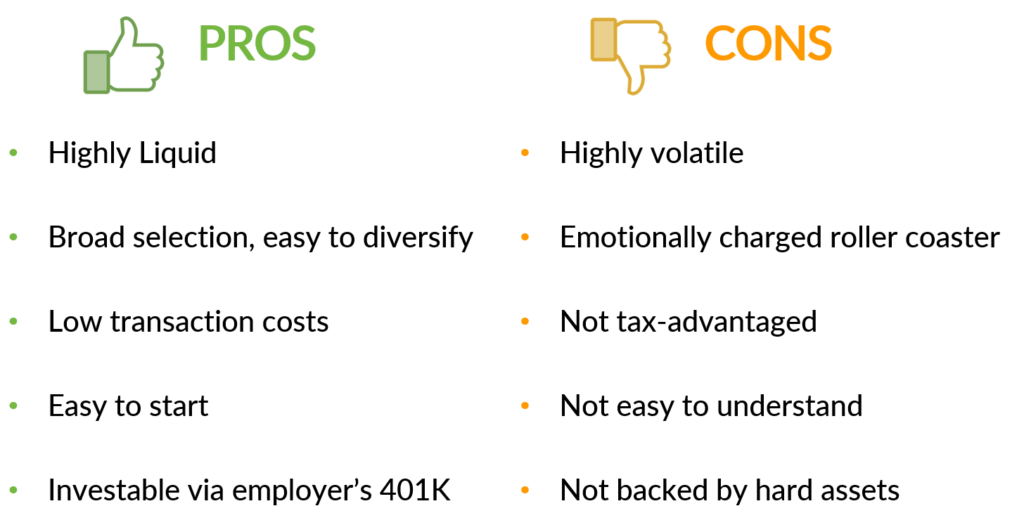

To be clear, any investment portfolio should have diversification, including equities and real estate. So, let’s dive into some of the PROs and CONs of each. I said I’d be balanced right?

STOCKS

You know these, the default investment for everyone it seems. You may have started with employer's 401K program or through their IRA they rolled over from a previous job. It takes $5 to make a trade and buy a share of stock. It's almost too easy. You can diversify and get in and out of stocks easily due to the broad range of companies to choose to buy shares in.

The rub comes with a small piece of news, a technical glitch, a tweet or someone woke up on the wrong side of the bed, the market goes haywire and you're on a roller coaster. The next day, someone sneezes, and the market goes back up. It can be a challenging and emotional ride. It's dangerous because you aren't a financial whiz in every industry or for every company you invest in, it is tempting to play with fire. And if it does go up in smoke, there's no hard asset backing the share, the money is gone and you either wait for the market to go back up or you sell and take your lumps.

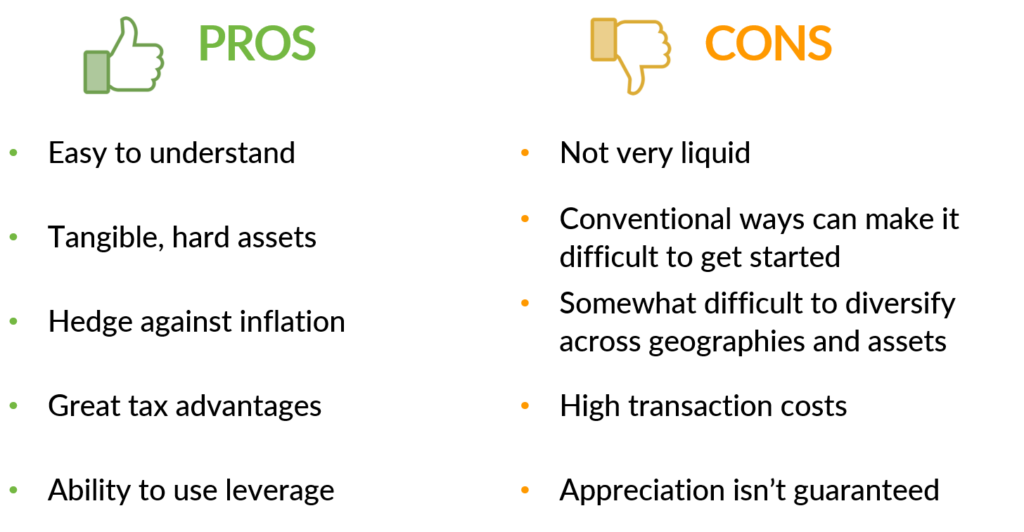

REAL ESTATE

With real estate, you get it. You need somewhere to live and at some point were forced to run the numbers to see if it fit within your budget. Real estate feels familiar because you can touch and feel it. It is an investment, that when you do it correctly, you can see go up in value and pay nice rewards. Because rent and housing are a part of the economy, rents go up over time and thus protect your investment from inflation.

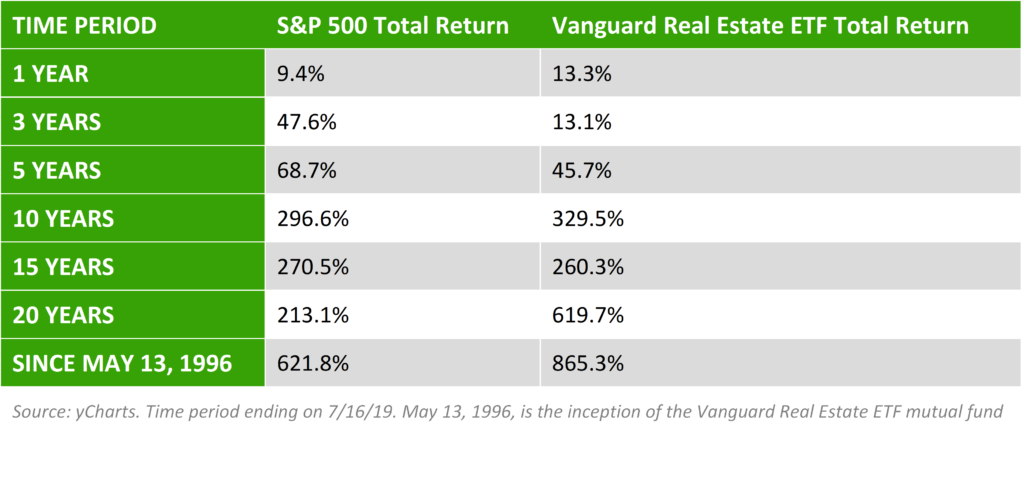

The tax advantages I've mentioned a few times before, specifically in this post where I go into more depth. There are many, it's as if the government wrote the tax code for real estate investors. This bias is also present in the fact that banks have it too - they love to lend to investors. Why can't you borrow money from the bank to invest in stocks? Because they hate the risk/reward ratio as much as we do. Real estate carries a strong stability and underlying asset value, so they will lend. What other investment lets you control a $500,000 asset with only 15% down? Amazing, increasing your returns dramatically. Speaking of returns, check this chart out - it speaks for itself.

All that gushing aside... it takes capital to get started. There are ways to get started cheaply, but to really invest, you need to have some capital, at least enough for a conventional loan down payment and closing costs. Speaking of closing costs - these transaction costs can be high as compared to other investments. Unless you set up a team of experts in different geographies and in different asset classes, it can be difficult to do this on your own. However, real estate syndications make this a moot point. Read more about it here. All that said, you can never know if the property will appreciate if you do nothing. It is in your control though so you can ensure appreciation happens.

As you can see there are PROS and CONs to both real estate and stocks. For me and my money - we'll invest in real estate (and also stocks), but mostly real estate... As one last plug for real estate

If you’d like to discuss how to invest in real estate via a syndication, I’d be happy to jump on a call with you. Schedule a call HERE.

If you’re ready to start exploring passive real estate investing, please sign up for our True Freedom Investor Network. It’s free to join with no commitment. It’s also the only way we can send you investment opportunities. Join now!

Great resources

https://www.biggerpockets.com/blog/real-estate-vs-stocks-performance

https://www.frbsf.org/economic-research/files/wp2017-25.pdf

https://www.investopedia.com/investing/reasons-invest-real-estate-vs-stock-market/

https://www.thebalance.com/real-estate-vs-stocks-which-is-the-better-investment-357992