by Joe Firmin 3 Minute Read

SURPRISE!!! 😲 Each time a recession hits, that’s what it feels like. Gut-wrenching, heart dropping feeling of ughhhhhh. Much, much worse than getting a surprise from your daughter, and no giggles either. It takes us by surprise - no matter if you’ve been through a recession before or whether you’re heavily involved in market trends examination or not. And yet, on average, since 1854, the US has experienced a recession every 3.2 years, it’s important to know what to expect and how to handle your investments during this time.

So, what happens to real estate in a recession? How much is the real estate market as a whole affected? And, the question on your mind, when is the right time to invest in real estate?

We’ve investigated, so let’s see the what history can teach us about the answers… This can help you look forward to the next few months or years and know when it’s the right time to buy again.

What is a Recession?

When the economy shrinks for at least 6 months or two quarters out of the year, the negative growth is called a recession. The GDP (Gross Domestic Product) represents the total value of goods and services sold within a country.

A recession is when the GDP goes down for at least six months consecutively. When GDP returns to pre-recession levels, that marks the end of the recession.

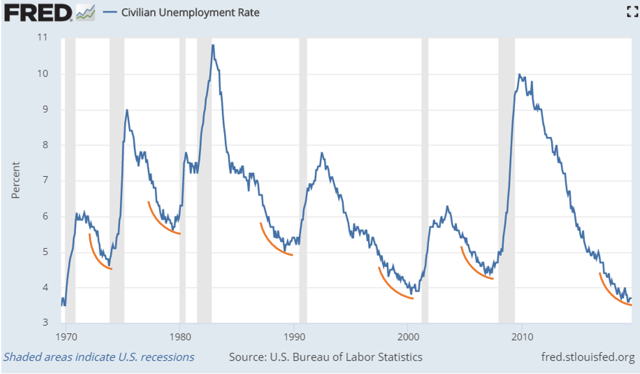

Red flags that a recession is happening or is very close are spiked unemployment rates and erratic stock market fluctuations. Experts often look toward history and highlight traits of The Great Recession of 2008 or even the Great Depression in the early 1930s.

By examining and understanding recessions and the sequence of events that occur before, during, and after a recession, you can purposely create life-changing wealth during the recovery period.

Where are we now, what should we expect, and when should we buy?

Based on previous recessions, here’s what could happen to real estate during the next recession and recovery cycle. Track your current experience and research of the US economy in comparison to the below stages, and you’ll be prepared when it’s the right time to invest.

Stage 1 - Unemployment Rates Increase

In the earliest stages of a recession, as I mentioned previously, unemployment rises. This is one of the big waving red flags that trouble is on the horizon. Businesses begin to feel the effects of fewer goods and services being exchanged (remember GDP?) and may close their doors or choose to furlough or lay off employees.

During the Great Recession of 2008, 2.6 million people were unemployed and now during 2020, the US has hit an astounding unemployment number of 30 million, a historic record. Red flags turning into red caution lights?

Stage 2 - Government Stimulus - $$$$

As we’ve seen in recent history (2008 and 2020) the government may step in with a stimulus in an attempt to boost the economy with cash. Sometimes programs are offered to keep businesses afloat, sometimes eligible households are sent currency, and sometimes all of the above.

Stimulus checks are a temporary bandaid that gets cash into the hands of Americans to encourage spending. This is why, for the first couple of months of a recession, mortgages and rents are still paid. But what happens when people are still unemployed, and they’ve spent their stimulus money?

Stage 3 - Loan Defaults

The longer businesses continue to close and consumer spending decreases, the more likely we will see loan defaults. As tenants are unable to pay rent, real estate owners deplete their reserves, and this results in a wave of defaults for residential and commercial loans.

As defaults occur, banks start to take over the properties, which brings us to the next step.

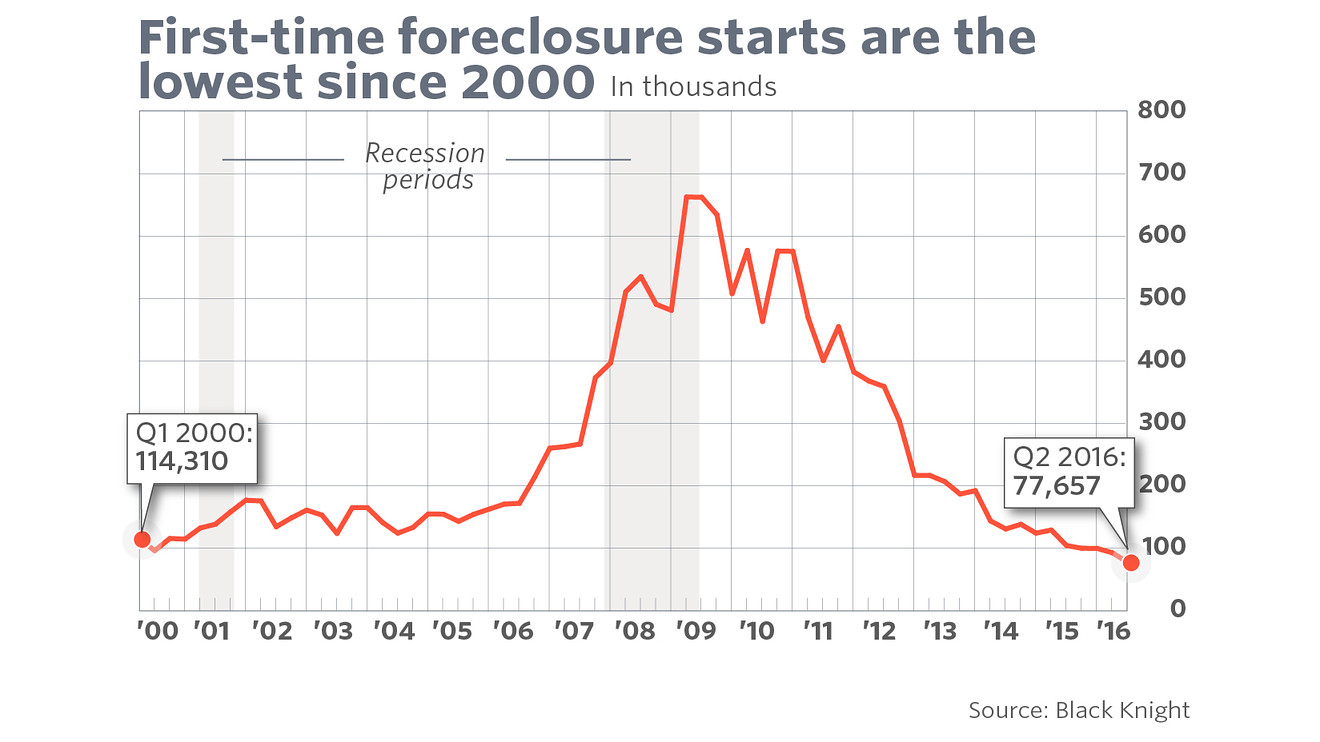

Stage 4 - Bank REO Properties

When loan defaults occur, banks foreclose on those properties. Then, a wave of bank REO (real estate owned) properties appear on the market.

Since banks aren’t in the business of property management, they are anxious to sell these properties quickly at a discount. At this point, real estate investors should be ready with their checkbooks.

Stage 5 – Go BUY!

In examining the real estate pricing cycle of the recent past, we saw peak market prices in 2019. So, when will bank REO properties begin to hit the market?

This depends on several factors, including the speed at which the real estate market reacts, which is slow. Examine the historic trends - notice the start of the recession versus when REO properties were at their peak. There could be years between these two events, which means patience is key.

Stage 6 – Inflation Nation

A rise in inflation is the inevitable final stage of the recession cycle. Inflation is the result of additional money being flooded into the economy (remember stage 2? Yikes.) and ultimately devalues the dollar.

This is precisely why the same dollar buys much less now than it did 10 years ago AND what makes real estate such a great investment. Real estate investments with a fixed-rate loan lock-in payments for about 30 years, hedging a bet against inflation. Real estate payments (think rents) are tied to the economy, so as inflation rises and housing costs along with it, investing in housing protects your liability to inflation risk – a true hedge.

As the value of your currency decreases, your mortgage payments remain the same and your real estate values appreciate.

What You Should Do Now

Investing and market cycles and our own individual experiences with these things comes with guaranteed uncertainty. However, by examining history and economic fundamentals, we can have a better idea of when each stage presented above will occur.

On the early tail-end of a recession, during the recovery, it’s likely that you’ll see unprecedented deals flood the market and you want to ensure you’re ready.

In the interim, the best thing to do is focus on education & mindset, in addition to readying your personal financial situation so that when a deal hits, you can confidently invest.

If you’re interested in learning more about investing in value-add investments and becoming a passive investor in real estate syndications, consider joining the Freedom Network. It’s absolutely free to join with no commitment necessary, seriously. If you don’t join, we won’t be able to send you opportunities (sorry, SEC rules). So join today! Not sure how it will work? Check out this post to understand the logistics.