3 ½ Minute Read

Have you been to Costco? Your cart filled up with cool stuff, you spent $300, and you don’t even know how it happened. Meanwhile, you lost a ton of time and didn’t really get what you needed? This is the same aimless frustration you might experience when you first start looking into real estate syndication investment opportunities.

It’s possible you’ll begin to receive a bunch of opportunity emails, each with a summary that could be 50 pages long! Without knowing specific tactics, your goals, and a strategy for looking at these opportunities, that aimless frustration might turn into overwhelm. “Ain’t nobody got time for that!”

Right here, right now, you’re going to learn how to decide within 5 minutes if a deal is right for you.

The First Five Glance

New deal alert emails are like a surprise gift. You had no idea it was coming, but you can’t wait to rip it open and see what’s inside.

The emails you receive about new deals are full of valuable information. I recommend focusing what I call the First Five: type of asset, market, hold time, minimum investment, and funding deadline.

If you open the email simply aiming to extract only these 5 pieces of information, you’ve already avoided unnecessary information overload. Answer this question with the first five glance: Do these data points match my investing goals? If not, there’s no reason to waste any further time. As an example:

You receive a Deal Alert!!! Here are the First Five:

- Asset Type: B-class multifamily

- Market: Dallas, TX

- Hold Time: 5 years

- Minimum Investment: $50,000

- Fund Deadline: 3 weeks from today

With this simple, first five glance information, you’re able to immediately see that although this is the perfect asset class and market you wanted , you are

aiming for a longer hold and you already know you need more than 3 weeks to access your capital. Easy decision – HARD PASS.

Another deal will pop up shortly and you’ll get opportunity after opportunity to practice this little exercise. At some point, the key will all be exactly what you’ve been waiting for and you’ll be able to jump on it and dig deeper.

The Numbers

Once you’ve decided a deal’s initial look aligns with your goals, it’s time to dig further into the investment summary and explore.

As an example, you might learn that this particular deal is offering:

- 8% preferred return

- 9% average cash-on-cash return

- 17% IRR

- 20% average annual return including sale

- 0x equity multiple

But what does all that mean for you and your $50,000?

In time, you’ll get lightning-quick at this and know right away what all of that means, but right now, let’s pretend this is your first go at it.

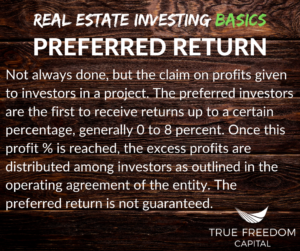

Preferred Return & Cash-on-Cash Return

Preferred return, a common structure for deals, means that the first percentage (in this case, 8%) of returns go 100% to the limited partner passive investors. Sponsors don’t receive any returns until the property earns more than that.

This means that if you invested 50K and everything went according to plan, you should see 8% of $50,000 or $4,000 this year, which breaks down to $333 per month.

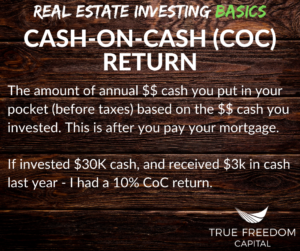

Since cash-on-cash returns are projected at 9%, that tells you that this deal is projected to pay out above the 8% preferred return at some point.

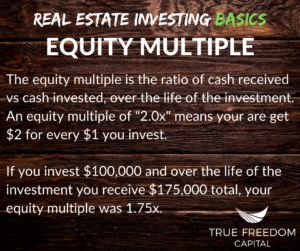

Equity Multiple

The next fun number on the list is the equity multiple. This number quickly tells you how much your investment is expected to grow during the project.

Continuing on the example above, your $50,000 investment with a 2x equity multiple should pay out to a total of $100,000 once the asset is sold. This accounts for the cash flow distributions during the hold period plus the profits from the sale.

We typically aim for a 1.75x - 2x equity multiple on deals, so you can use that as your benchmark.

Average Annual Return & IRR

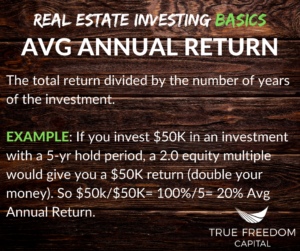

My last two concerns when initially examining a new deal alert are the average annual return and the IRR.

The average annual return tells you what the average earnings are over the hold time.

The average annual return tells you what the average earnings are over the hold time.

In the example above, we discovered that your $50,000 is expected to double to $100,000 over the next 5 years. That total return is 100% of your original investment, and when divided over the 5 year hold period, we see that your average annual return is 20%.

The IRR (internal rate of return) is the average annual return (in this example 20%) and adjusts for the time delay.

Since most of your earnings are expected later, at the sale, and time has cost associated with it, the IRR takes that into account. An IRR of 14% or more is a great target.

The Decision

After this 5-minute analysis of these points, you should be able to tell if this opportunity is good for you. Either way, this isn’t a final decision and it doesn’t mean you’re putting in a wire transfer this afternoon, but it does mean you can decide I you want to spend more time reading into the investment summary or not, and you can make that decision with confidence.

If the numbers align with your investing goals, you can go ahead and let the sponsor know you’re interested by requesting the full investment summary or submitting a soft reserve.

Recap

New investment deal opportunities can be exciting, but if you get lost in the weeds too quickly, they can become overwhelming.

Whether you’ve had funds ready for weeks or are still in limbo getting them rolled over into a self-directed IRA, it’s imperative to know exactly what you’re looking for so you can jump on the perfect deal and minimize wasted time.

With the points discussed above, you’ll be able to identify if a deal is even worth your time and energy right off the bat.

If you decide you want to be a hands-off investor and invest in real estate syndications, join the Freedom Network. It’s absolutely free to join with no commitment necessary, seriously. If you don’t join, we won’t be able to send you opportunities (sorry, SEC rules). So join today! Not sure how it will work? Check out this post to understand the logistics.